Every tradie wants to grow a business that’s profitable, reliable, and sustainable. Yet the truth is, many skilled tradespeople struggle to keep their finances under control. That’s why financial excellence for tradies is at the heart of Pillar 12 of the ResVita 12 Big Pillars. It’s about knowing your numbers, protecting your cashflow, and making confident decisions that secure your future.

Resvita is here to make that a reality. By leveraging structured frameworks like the Core 9 and 180 Power Frame, Resvita helps tradies master financial excellence, streamline operations, and unlock long-term business success. you can find out more about those by Clicking Here.

Why financial excellence matters

You can be the best carpenter, tiler, or painter in town, but if your financial systems are weak, your business will always be at risk. Late invoices, poor cashflow, and unclear profit margins can drain your energy and leave you constantly chasing your tail.

Financial excellence changes that. Instead of guessing where your money is going, you gain clarity. Instead of waiting until tax time to review your numbers, you keep track weekly. And instead of scrambling to pay wages, suppliers, or the ATO, you have cash reserves in place to cover your commitments.

How to achieve financial excellence for tradies

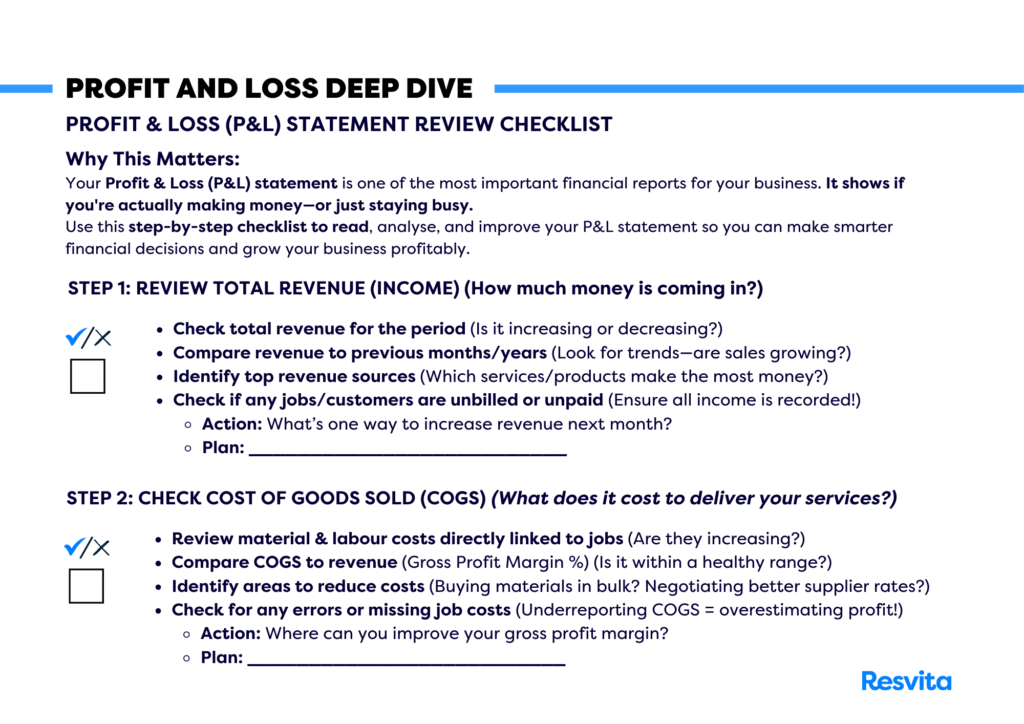

1. Understand your numbers

It starts with knowing the basics: your revenue, expenses, gross margin, and net profit. Simple bookkeeping software like Xero or MYOB can show you real-time data, but only if you keep it up to date. Clarity comes from discipline. Once you know your break-even point, you can price jobs confidently.

2. Keep cashflow king

Cash is the oxygen of any trade business. Send invoices as soon as jobs are complete, set strict payment terms, and follow up overdue accounts quickly. A separate tax and GST account ensures you’re never caught short when obligations fall due.

3. Benchmark your profits

Comparing your numbers against industry averages helps you see if you’re truly competitive. For example, painters might expect net margins of 20–35%, while carpenters may sit closer to 10–20%. If you’re falling short, review your pricing, reduce waste, or renegotiate supplier deals.

4. Control costs without cutting corners

Financial excellence doesn’t mean penny-pinching. It means being smart about where your money goes. Negotiate with suppliers, track material usage, and reduce overtime blowouts. Efficiency pays off.

5. Plan for growth and setbacks

A financial plan isn’t just about profit. It’s also about preparing for challenges — a slow season, broken equipment, or unexpected medical leave. With proper reserves, you protect both your business and your people.

The benefits of financial excellence for tradies

When you pursue financial excellence for tradies, you don’t just improve your bank balance — you build stability, trust, and freedom.

- Better decision-making: With accurate numbers, you can choose which jobs to take on and which ones to avoid.

- Stronger reputation: Clients and suppliers trust tradies who pay on time and run professional operations.

- Less stress: When cashflow is steady, you stop lying awake at night worrying about bills.

- Scalable growth: Financially sound businesses can expand confidently, whether it’s hiring more people, buying new equipment, or taking on larger contracts.

- Personal security: A profitable business protects not just your livelihood, but also your family’s future.

A practical example

Imagine you run a plumbing business. In the past, you relied on memory and paper invoices. Some clients paid late, others slipped through completely, and cashflow always felt tight.

Now, you’ve adopted a financial excellence mindset:

- You send invoices immediately after finishing a job.

- Payments are chased automatically by your accounting system.

- You track margins monthly, comparing them against ATO benchmarks.

- A percentage of each payment goes into a tax reserve account.

- You hold three months of operating expenses in savings.

The result? You never scramble for payroll. You invest in better equipment without fear. And you sleep easy, knowing your numbers are in control.

How to start today

- Review your current financial system — what’s working, what’s messy.

- Choose a simple accounting platform and commit to weekly updates.

- Create a separate tax and GST account.

- Set your break-even point so you know the minimum revenue required each week.

- Build a cash buffer — aim for at least three months of operating expenses.

Final thought

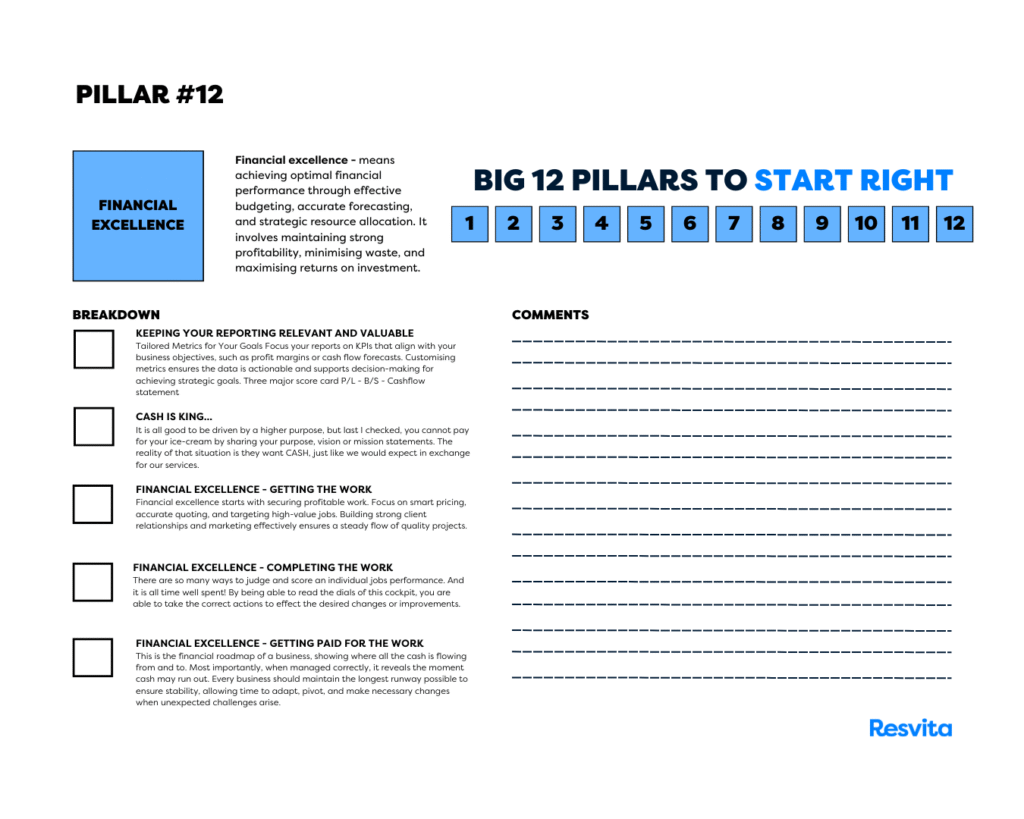

Pillar 12 of the 12 Big Pillars is about building strength through numbers. By mastering financial excellence for tradies, you give your business stability, your team security, and yourself peace of mind. It’s not about making finance complicated — it’s about making it clear, consistent, and aligned with your goals.

With the right systems in place, financial excellence stops being a dream and becomes your reality.

So, ready to swap stress for strategy? Dive into Resvita’s Core Blueprint today and build a business that thrives, no matter the weather.

Go and complete our Blueprint to Brilliance Scorecard to start to really uncover

– What’s Currently Working and How to Get More

– What’s Not Working and How to Fix It

– What is needed to get to the next level!

It takes less than 5 minutes to complete!

Click Here to go to the scorecard